Annuities Can Reduce Taxes and Medicare Part B Premium Increases while Linking Your Money Only to Gains

Starting 2007 the law began to increase Medicare Part B premiums for those with highest modified adjusted gross income (MAGI). In addition, if you have a high MAGI, you have been paying taxes on your Social Security income. Almost anything that reduces MAGI can increase the money coming to you. Because of the tax advantages afforded to annuities, you can reduce the money reported on MAGI. The earlier you begin to take advantage of this vehicle, the more prudently your money is allowed to work for you. When planned to suit your need, backed by the strength and claims paying history of the issuing companies, fixed and fix-indexed annuities seem to equate to Noah’s Ark among the financial asset classes. They offer your nest egg an unparalleled safety, guarantee, and tax advantages so you can best plan for your retirement and legacy needs.

MAGI is the usual adjusted gross income plus some “add-backs” like muni-bond interest or interest excluded from saving bonds. If you have a high MAGI amount, the tax can be on as much as 85% of Social Security income. And by 2009, you can expect to pay up to 80% of the Medicare Part B premium—that is at least $3,600 annually based on the current premium—if you do not lower your MAGI. Basically, the higher your MAGI, the more you will pay to the government.

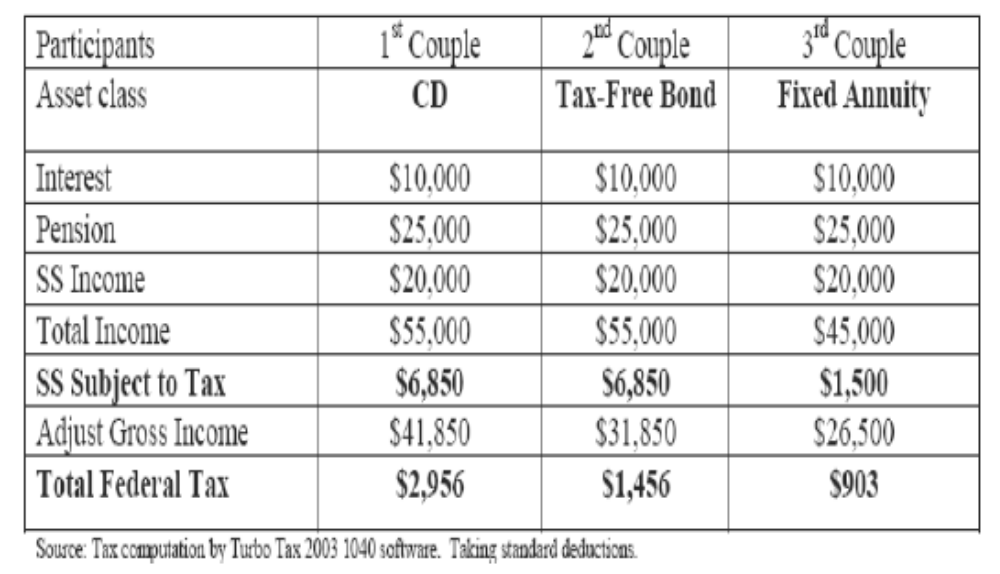

Consider the below hypothetical example: 3 couples, each receiving SS income of $20,000. Also, each couple has non-qualified money of $200,000, earning 5% annual interest with the earned interest reinvested, in the following asset classes:

The couple who purchased the fixed annuity paid the least tax. How can it be that a tax deferred annuity beat a tax-free municipal bond? In the calculation of tax on Social Security income, and now to calculate Medicare premium increases, the IRS includes municipal bond interest in the total income to determine how much to tax and charge you respectively for these benefits. In our example above, the annuity purchase saves $2,000 annually in federal income tax. But would not this extra interest get paid back later? No! Even if this money is distributed entirely years later, you do not pay above the maximum threshold set by the government. Tax deferral gives you tax control. You now have a choice when you want to distribute the money. There is no minimum required distribution of non-qualified money inside an annuity. The annual savings from owning an annuity is permanent, compounding and does not get paid back later.

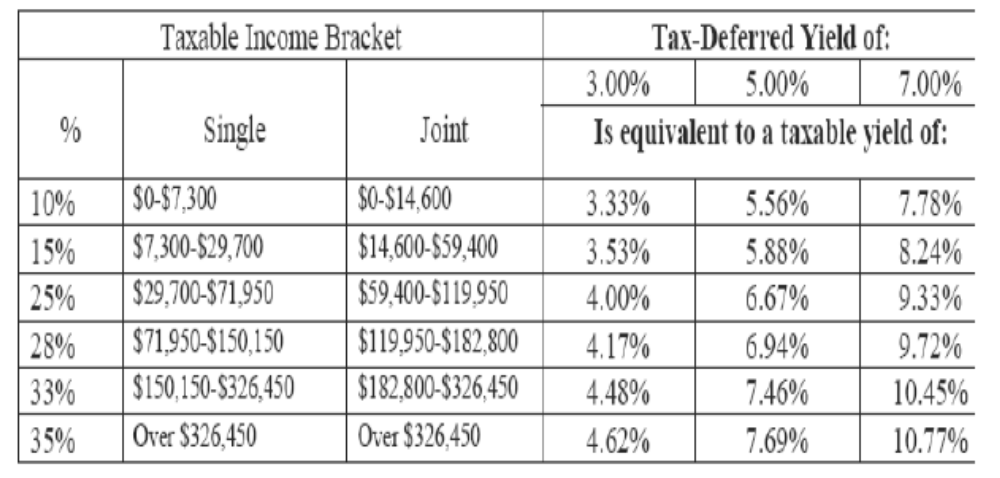

Now consider the following comparisons of tax-deferred equivalent yields for various tax brackets based on a 2005 tax rate schedule:

Based on this illustration, your deferred annuity’s annual 5% yield is equivalent to a 6.94% yield of a CD if you are within a 28% tax bracket.

With fixed and fixed indexed annuities, you have an option to save on federal taxes, get a higher Social Security checks because less of the benefit is taxed away, avoid Medicare premium increases, and take advantage of the triple-compounding growth of your money—sheltered from creditors and lawsuits.

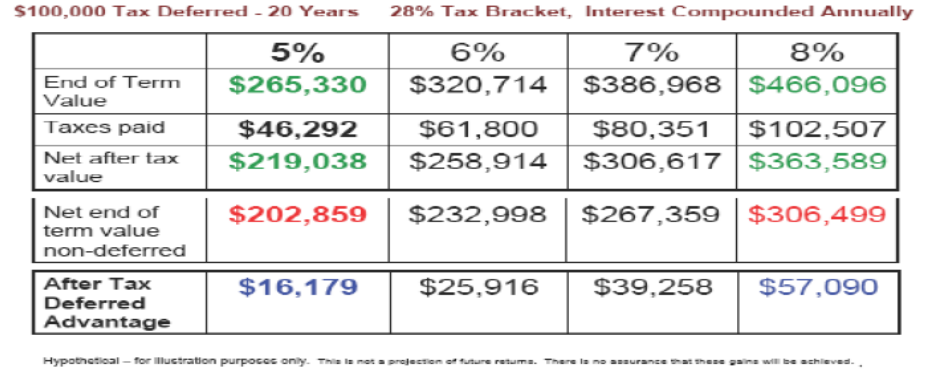

Now let’s look at the tax deferral advantage over a period of 20 years of $100,000. With non-qualified money (that money that as already been taxed or non-401k or non-IRA type of money) inside an annuity there is no required minimum distribution. What this means to you is that if you can now grow your money tax deferred, then you can have various options to utilize this money. You can freeze the accumulated money to live off of the earned interest only. Or you can turn some of the money into a stream of income while letting the rest of it grow. Or walk away with a lump-sum or whatever variations that might be fitting to your need. Even if you cash in all the money at once after the 20y years period, you still have $16,179 more gain than having your money inside a taxable account.

Contrary to the common belief, your premium, any-bonuses and benefits of fixed and fix-indexed annuities are not affected by your agent’s commission level. The expenses associated with each of these annuity policies are already accounted for by the issuing annuity company. These policies—their corresponding premiums, applications and any-marketing materials—are regulated and filed-with your state’s department of insurance before they are made available to the public.

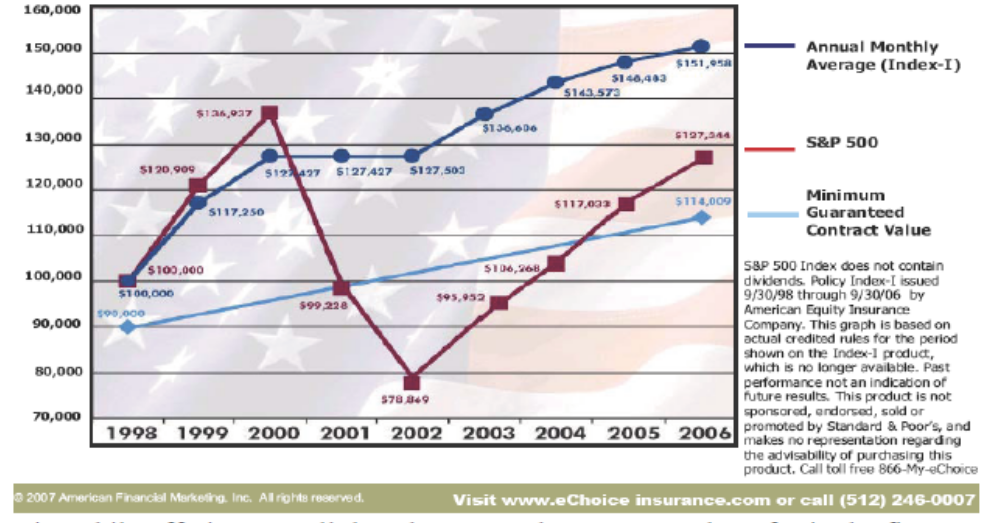

The power of annually resetting fix-indexed annuities is that it allows the market volatility to work for you. It gives you the opportunity to be linked to the gains of the indexed market, locking out the bad years. Depending on the specific policy, gains between the two anniversaries can become a vested part of your portfolio and locked in annually. This provides you with an option to earn more interest than with a CD-like fixed annuity while offering you all the advantages that you came here for in the first place.

Whether you are a conservative or aggressive investor, fixed and fix-indexed annuities shine as Noah’s Ark among the financial asset classes. Regardless of your tax bracket, you can benefit from annuities. The earlier you plan for your financial future, the better your money can work for you and your loved ones. You should consult your retirement professional if you are considering the safety, guaranty or tax advantages afforded to annuities.

Huda H. Shams is the founder of E-Choice Insurance Services Inc. Huda’s specialty has been to ethically guide her customers so they may plan for a sustainable asset management while minimizing risk in the financial portfolio. This is not intended to be tax or legal advice. Consult your attorney or financial advisor.